Evaluating Employee Benefits: The Significance of Employer-Provided Health Insurance

- info483205

- Feb 6, 2024

- 2 min read

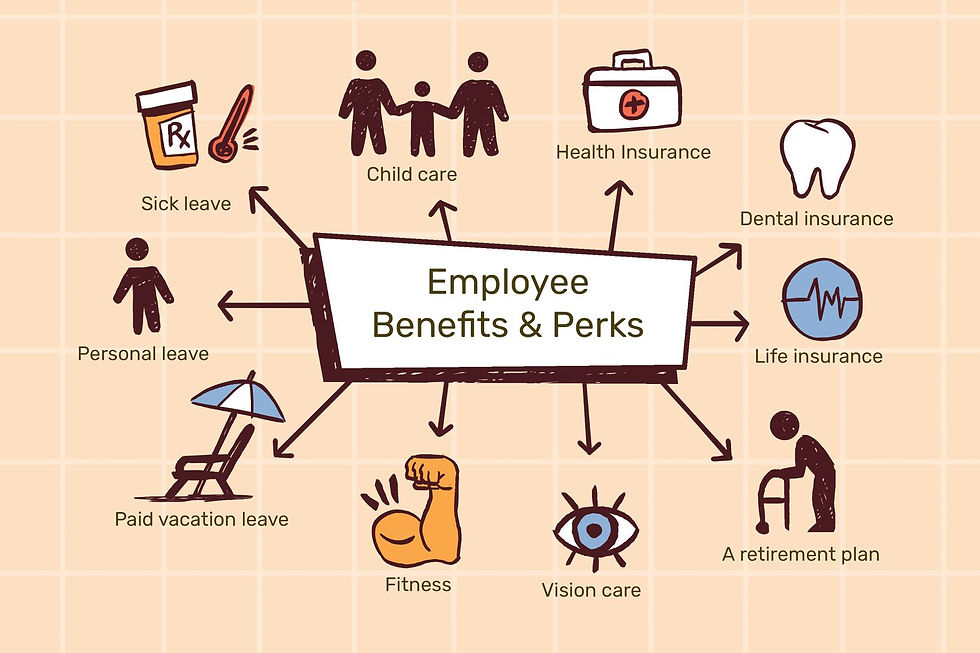

Employee benefits are a crucial aspect of a compensation package, playing a significant role in attracting and retaining talented individuals within an organization. Among these benefits, employer-provided health insurance stands out as one of the most valued and sought-after offerings. In this blog post, we will delve into the importance of employer-provided health insurance and how it impacts both employees and businesses.

Understanding Employer-Provided Health Insurance:

Employer-provided health insurance is a benefit offered by employers to their employees, covering a portion or the entirety of their healthcare expenses. This insurance can encompass various medical services, hospital stays, prescription drugs, preventive care, and more.

The Value of Employer-Provided Health Insurance:

Enhanced Attractiveness to Employees-

Offering health insurance gives businesses a competitive edge in the job market. Prospective employees often prioritize companies that provide comprehensive health coverage. It reflects a company's commitment to the well-being and security of its workforce.

Retention and Employee Satisfaction-

Employees who have access to employer-provided health insurance are more likely to stay with their current employer. Knowing they have reliable health coverage creates a sense of job security and well-being, fostering employee satisfaction and loyalty.

Tax Benefits for Employers and Employees-

Employer contributions toward employee health insurance premiums are typically tax-deductible, reducing the overall tax liability for the business. Employees also benefit as their contributions are often made on a pre-tax basis, providing tax advantages.

Group Rates and Cost Efficiency-

Employer-provided health insurance often secures group rates, resulting in lower premiums and overall costs for both employers and employees. The collective purchasing power of a group can drive down the costs of insurance.

Access to Preventive Care-

Health insurance encourages employees to seek preventive care and early medical intervention. Regular check-ups and timely medical attention can prevent minor issues from escalating into major health problems.

Promoting a Healthy Workforce-

By providing health insurance, employers encourage their staff to prioritize their health. A healthy workforce leads to increased productivity, reduced absenteeism, and improved overall workplace morale.

Evaluating Employer-Provided Health Insurance:

Coverage and Inclusions-

Evaluate the extent of coverage provided, including doctor visits, hospital stays, prescriptions, and preventive care. A comprehensive plan should cover a wide range of medical needs.

Costs and Contributions-

Consider the premium costs and the portion covered by the employer. Additionally, assess deductibles, copayments, and coinsurance to understand your out-of-pocket expenses.

Network of Providers-

Ensure that the insurance plan has a broad network of healthcare providers, hospitals, and specialists to give employees ample choices for medical care.

Employee Feedback and Satisfaction-

Gather feedback from employees about their experiences with the health insurance plan. Understanding their satisfaction levels can help in assessing the plan's effectiveness.

Employer-provided health insurance is a significant benefit that impacts both employees and businesses positively. It contributes to employee well-being, job satisfaction, and ultimately, a healthier and more engaged workforce. For businesses, it enhances recruitment, retention, and overall employee productivity.

Employers should carefully evaluate health insurance options to ensure they provide the best coverage possible, aligning with their organizational values and employee needs.

Comments